The holiday season often brings a welcome pause in our busy lives, offering time for reflection, connection, and sometimes even tackling those long-postponed tasks. While planning holiday events, why not take a moment to review your estate planning and prepare an Executor’s binder? It’s a gift to your loved ones that will last far beyond the holiday season.

A well-organised estate plan is one of the most thoughtful legacies you can leave. I recall an estate administration case where the deceased had prepared a comprehensive binder addressed to her executor. It included her Will, financial details, and family information—everything we needed to begin administering her estate. That binder inspired me to encourage clients to create their own “Executor Binder.” Here’s how you can do the same:

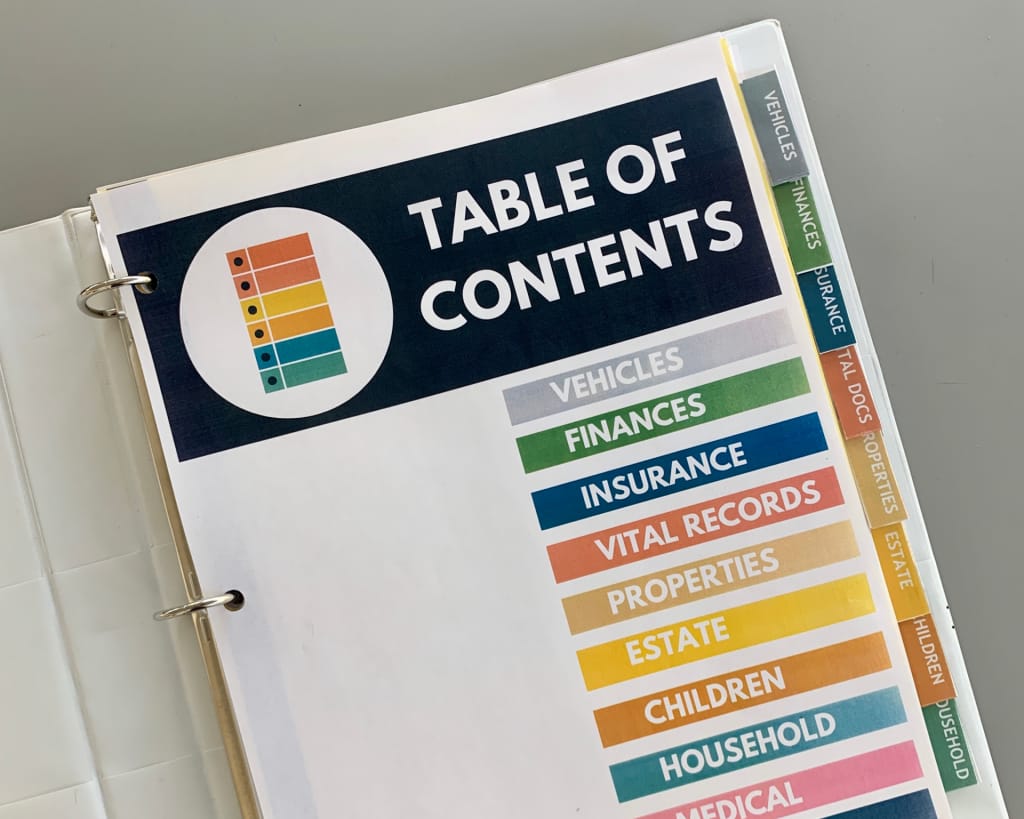

What to Include in Your Executor’s Binder

- Personal and Family Information

- Copies of birth certificates, marriage licenses, and divorce orders.

- Instructions on where to find your identification documents.

- Information about your spouse and children (e.g., birth certificates, addresses, contact details).

- A list of your doctors and specialists for easy contact.

- Financial Information

- Copies of recent account statements for chequing, savings, retirement, and non-registered accounts.

- Insurance policy details, including account numbers and advisor contact information.

- A list of account numbers and branch contact details for your bank accounts.

- Real Estate and Ownership Documents

- Deeds, mortgage documents, and homeowner insurance policies for real estate.

- Ownership papers for vehicles, boats, or trailers.

- Existing Estate Planning Documents

- Copies of your Will, Power of Attorney, and any trust agreements.

- Ongoing Expenses

- A schedule of recurring bills, including payee details, approximate amounts, payment dates, and account numbers.

- A chart outlining which accounts payments are made from to keep your executor informed and keep your household running smoothly.

- Digital Assets

- A list of email, social media accounts, online subscriptions, associated passwords, and instructions.

- Unique Assets

- Documentation for special collections like art, stamps, or firearms, including purchase invoices or appraisals if available.

- Funeral Directions

- Organ donation preferences, pre-paid funeral arrangements, and cemetery plot information.

- Specific funeral instructions to ease decision-making for your loved ones.

- Executor and Beneficiary Contact Information

- Provide precise contact details for your executor and beneficiaries, including phone numbers, email addresses, and any alternate executors’ information. This ensures they can be reached quickly when needed.

Additional Tips for Your Executor’s Binder

- Legal and Tax Considerations Consult with a lawyer or accountant to ensure your estate plan is structured to minimize tax implications and comply with legal requirements.

- Secure Management of Digital Records Consider using password managers or encrypted USB drives to store sensitive digital information securely.

- Regular Updates Schedule an annual review of your Executor Binder to ensure the information remains current, especially after significant life events like a move, marriage, or new financial accounts.

- Communication with Loved Ones: Discuss your estate plans and the location of the binder with your executor and close family members. Transparency helps prevent confusion and ensures smooth administration.

Storing Your Executor’s Binder

Once your binder is complete, please keep it secure, such as a locked filing cabinet or in-home safe. Ensure your executor or a trusted family member knows where to find it. Avoid using a safety deposit box, as it may require a grant of probate to access.

Make It a Resolution

The quieter pace of the holidays is the perfect time to consider your estate affairs. Make a New Year’s resolution to organize an Executor Binder—a thoughtful step ensuring your legacy is managed smoothly and carefully.

Wishing you a joyful holiday season and a prosperous New Year.